FY 21 ACTUAL VS. FY 22 BUDGET FUNDING

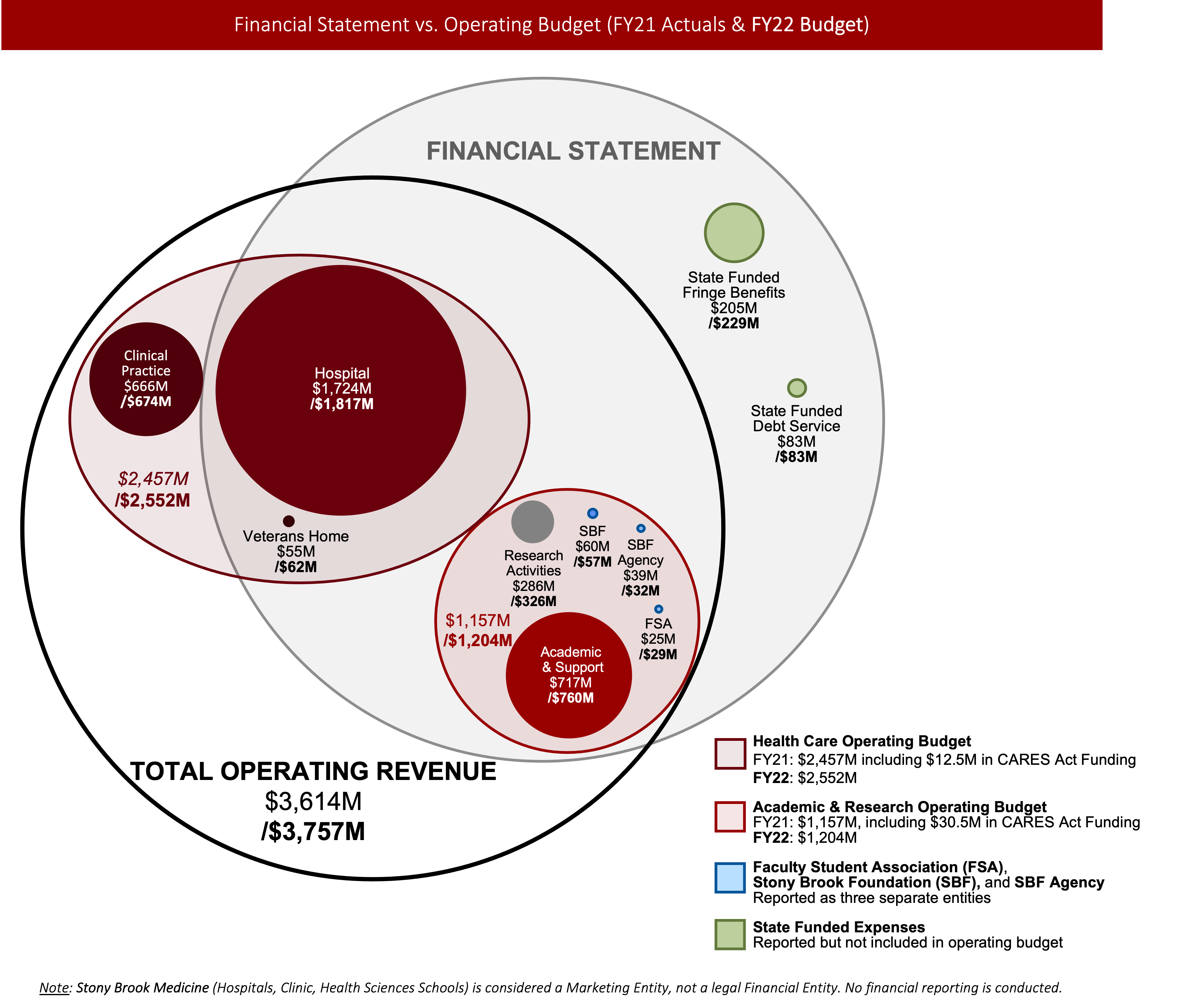

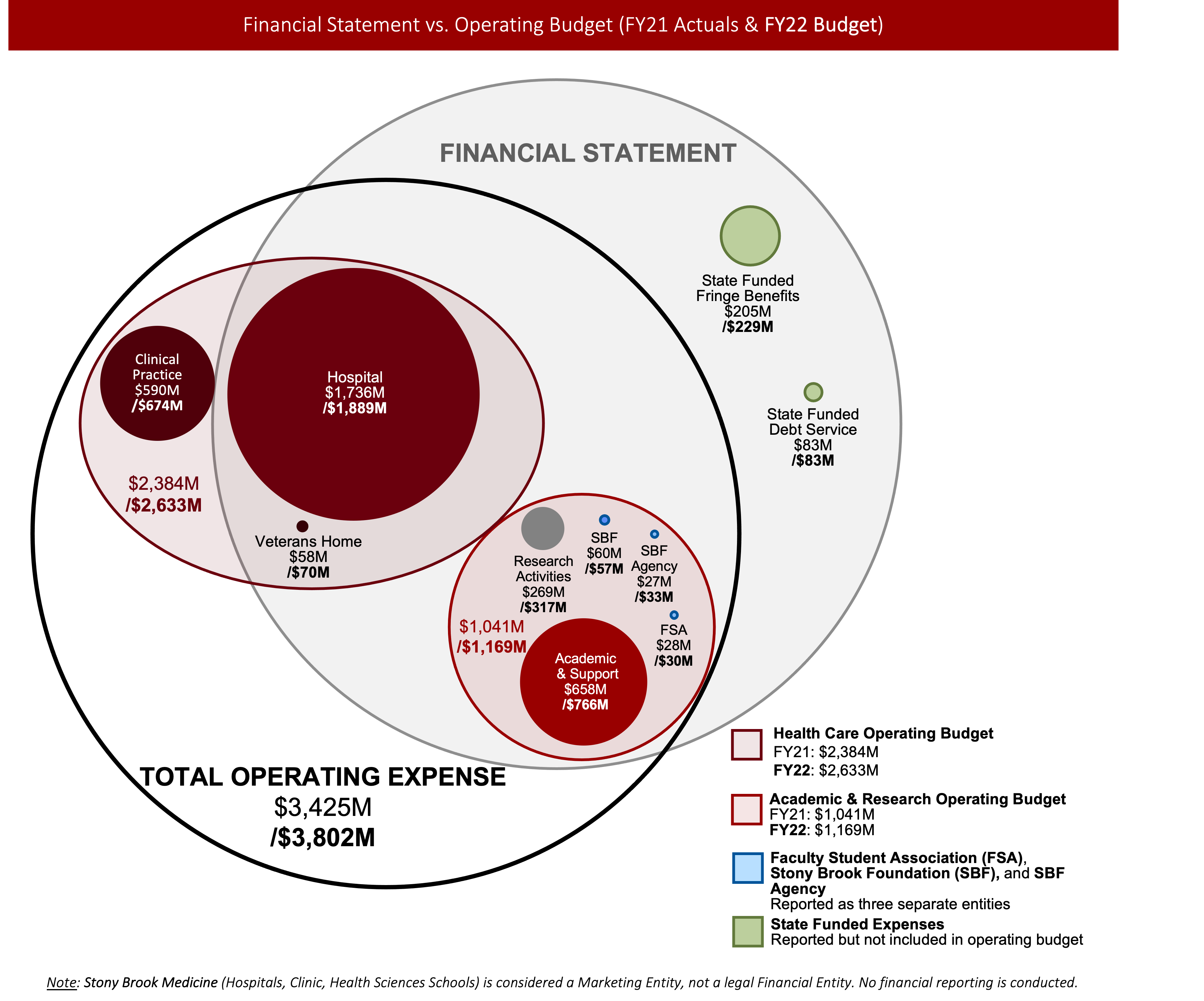

FINANCIAL STATEMENT VS. OPERATING BUDGET

FY 21 Actuals and FY 22 Budget

This graph compares Stony Brook's actual funding in FY21 with budget funding for FY22

(in bold).

Please note that total operating revenue does not include the portions of state support

paid directly by NYS on our behalf, such as payments for State debt and State fringe

benefits (e.g. health care and retirement for faculty and staff). Debt service and

fringe benefits expenses that are assessed locally and funded by the University are

included in the above figures. Though included within this presentation, the SUNY

financial statements for SBU do not include the $666 million in funding derived from

the Clinical Practices.

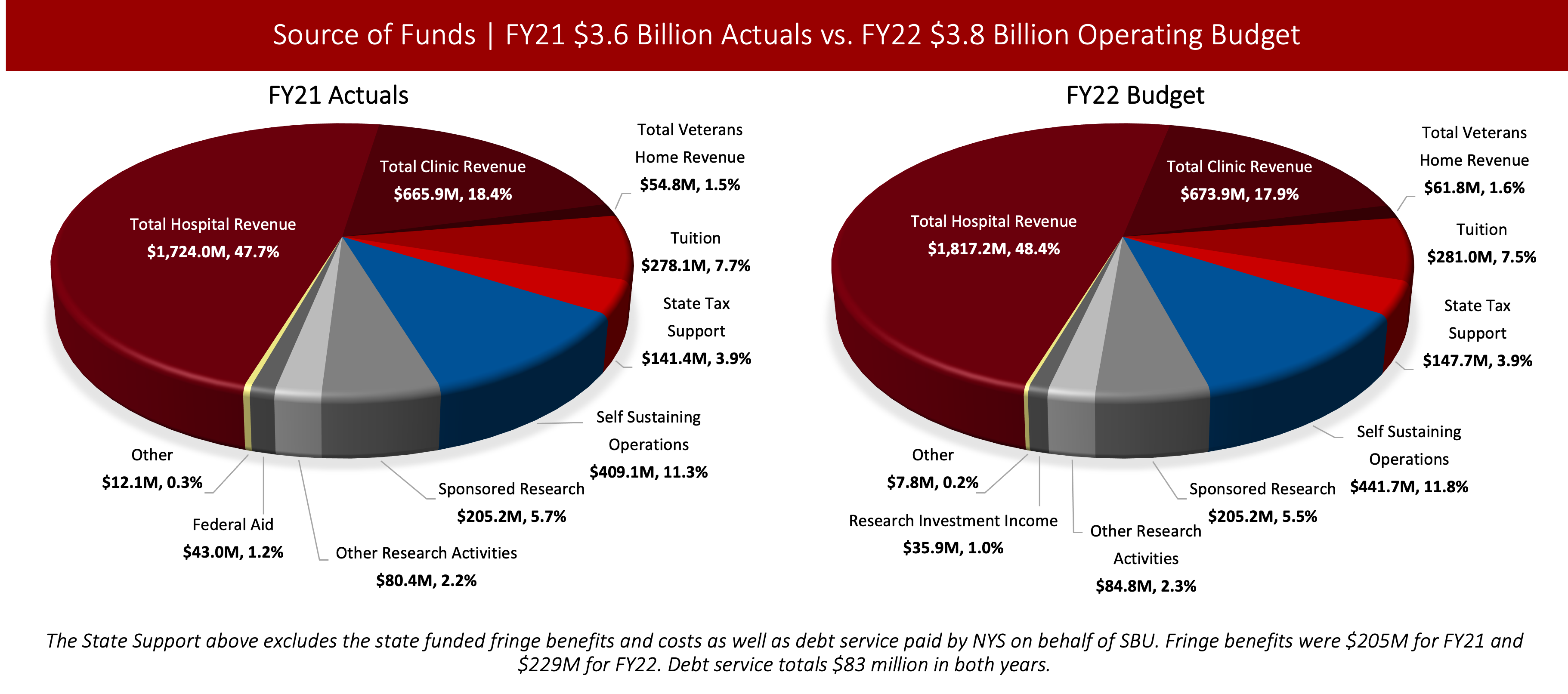

SOURCE OF FUNDS

FY21 $3.6 Billion Actuals vs. FY22 $3.8 Billion Operating Budget

These charts show sources of funding across the organization, comparing actual finding

during the 2020/21 financial year (FY21) and budgeted funding for the 2021/22 financial

year (FY22).

We anticipate increased funding and costs in FY22 as Stony Brook returns to a more typical capacity

and level of operations. Many revenue-generating entities have returned to full operation,

and we expect to incur additional costs as compared with FY21 due to filling positions

which had been left vacant, as well as certain increased non-payroll expenses.

Based on our anticipated expenses, the anticipated $45 million operating deficit will

be covered with the rollover of unexpended FY21 funds.

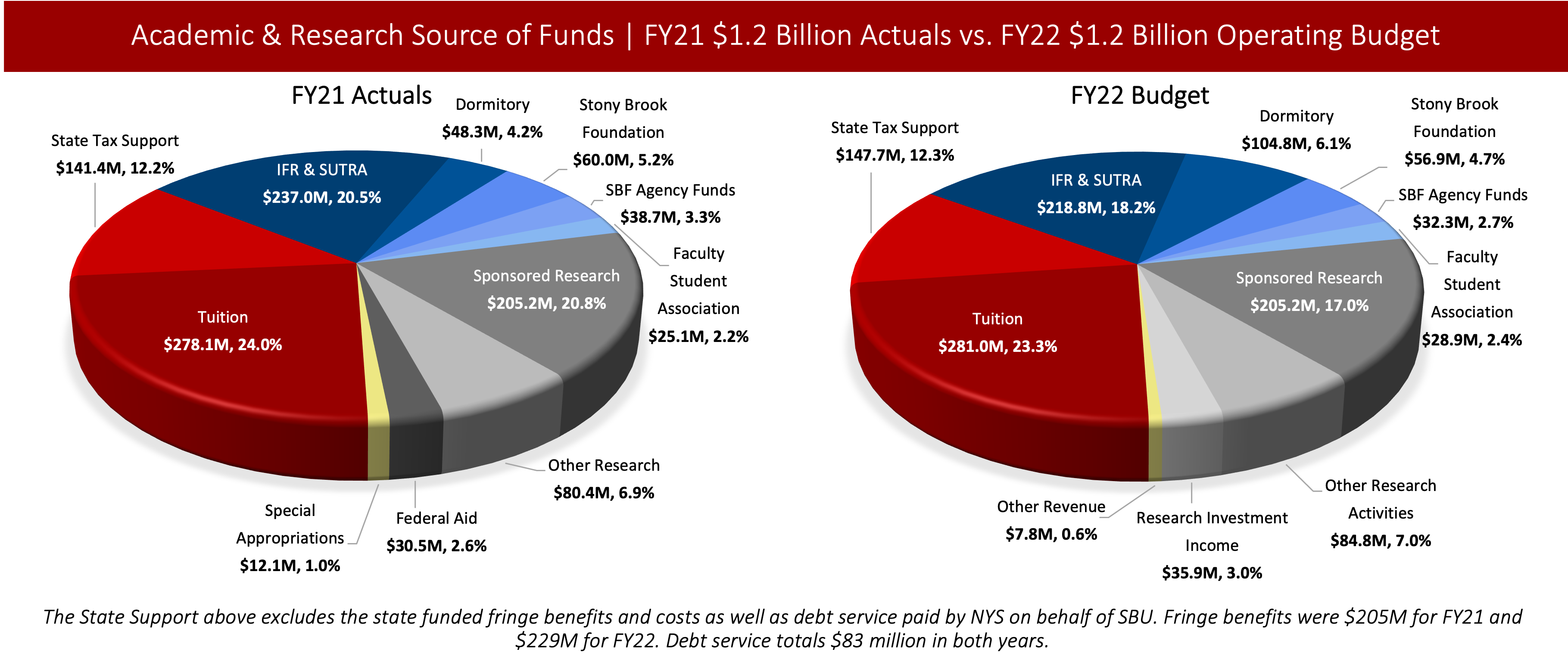

ACADEMIC AND RESEARCH SOURCE OF FUNDS

FY21 $1.2 Billion Actuals vs. FY22 $1.2 Billion Operating Budget

The total academic and research operating budget increased slightly from $1.16 billion

in FY21 actuals to $1.20 billion in the FY22 budget. This increase is largely driven

by the expectation of a return to full capacity in the residence halls for FY22, resulting

in a $56.5 million increase in the dormitory revenue budget. We also have included

in the budget $36 million in expendable returns from Research Foundation investments.

These increases are offset by a decrease in revenue since the $30.5 million in FY21 CARES Act funding is not expected to recur in FY22. As with FY21, we expect our academic and research revenue to exceed expenses in FY22.

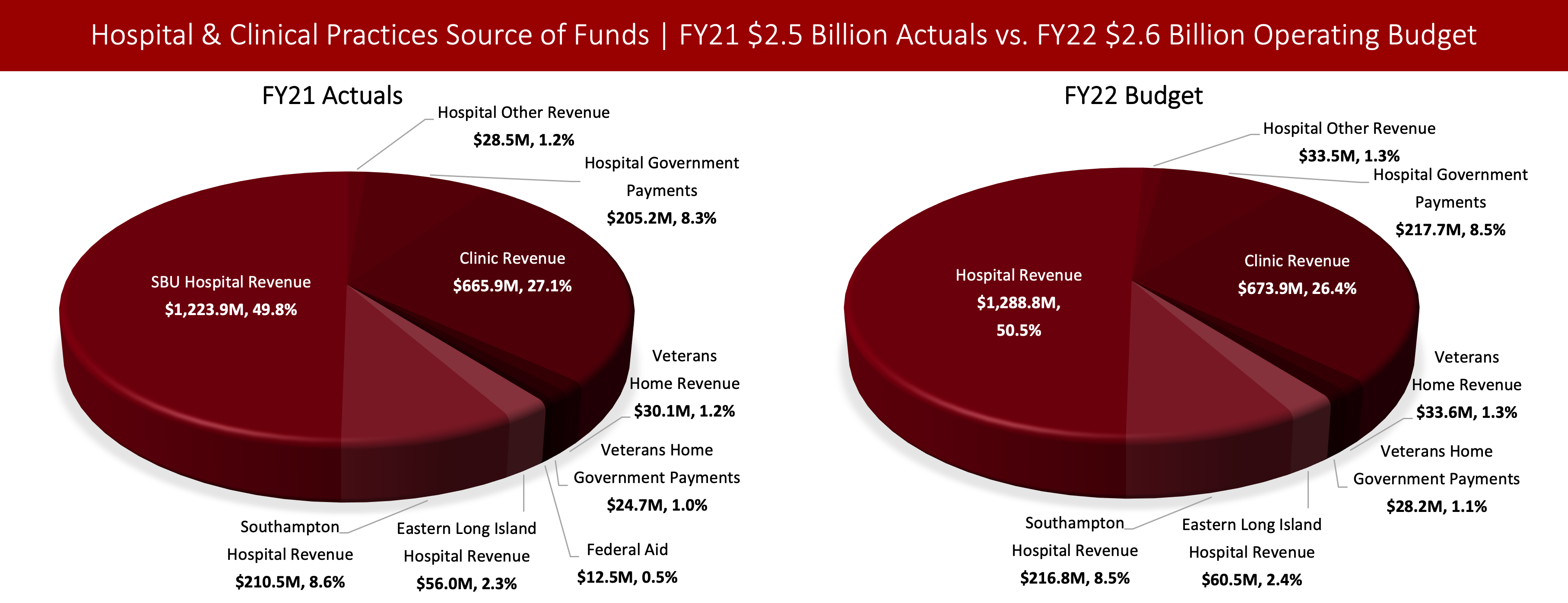

HOSPITAL AND CLINIC PRACTICES SOURCE OF FUNDS

FY21 $2.5 Billion Actuals vs. FY22 $2.6 Billion Operating Budget

The hospital and clinical practices budget increased slightly, from $2.5 billion to

$2.6 billion, for 2020/21. In the FY21 chart, Clinic Revenue and Clinic Fee for Services

have been combined into a single line item—Clinic Fee for Services—reflecting all

revenue generated from Clinical Services.

The hospital and clinical practices budget increased slightly, from $2.5 billion in FY21 actuals to $2.6 billion budgeted for FY22. We expect to see increases in funding for each category aside from Federal Aid; however, we anticipate costs outpacing revenue by $80 million for FY22. While most operations are expected to return to previous levels of activity, some units—such as the Long Island Veterans Home—will continue to operate at a loss through FY22 due to COVID-19 impacts, leading to this net deficit.

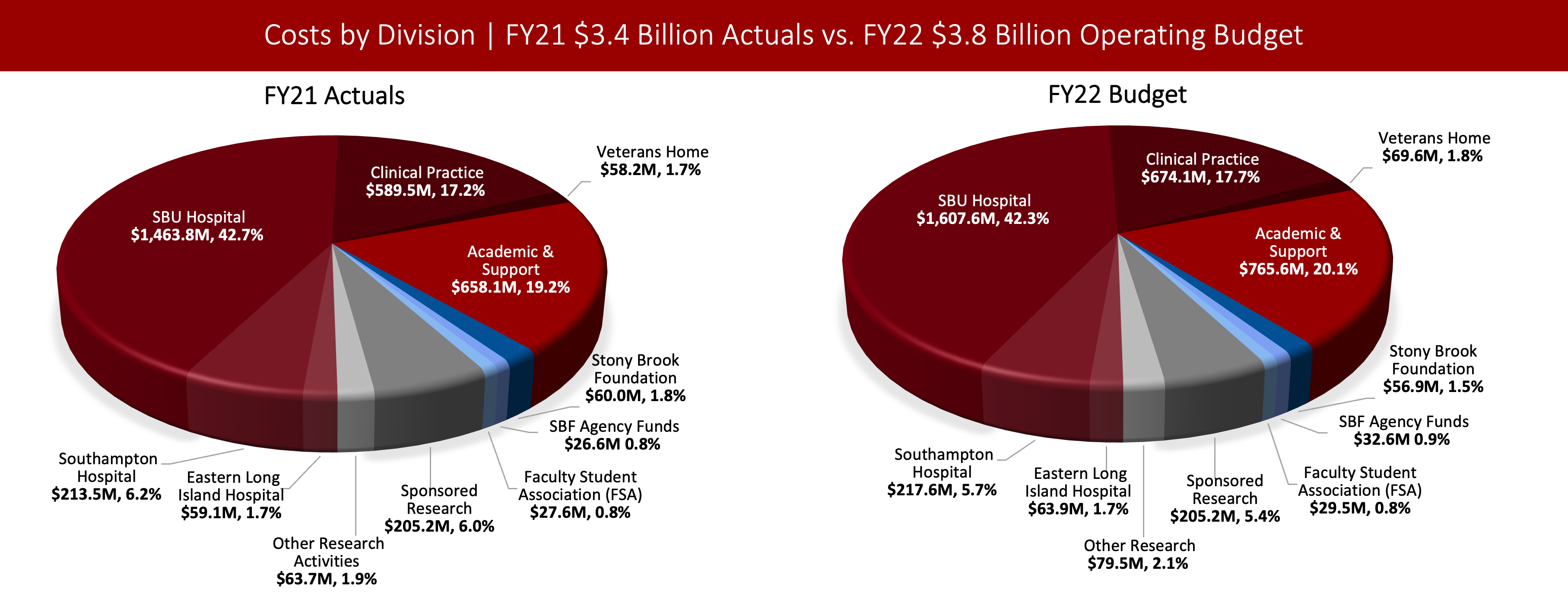

COSTS BY DIVISION

FY21 $3.4 Billion Actuals vs. FY22 $3.8 Billion Operating Budget

These charts compare Stony Brook’s costs by division during FY21 with budgeted expenses

for FY22. Due to the restoration of regular capacity and operations, we anticipate

increased expenses from $3.4 billion in FY21 to $3.8 billion in the FY22 budget.

While spending restrictions and hiring holds dampened FY21 spending, we expect increased spending in FY22 as campus activities rebound, spending restrictions are lifted, and inflation affects our costs.

Recall that we anticipate Stony Brook’s expenses in FY22 to outpace revenue by net $45 million. FY22’s expected increase in expenses is largely due to higher costs as we return to normal operating levels after FY21’s pause in hiring, SUNY-imposed expenditure reductions, and other operating expense limitations. While realizing these costs in FY22 reflects a net FY22 deficit, delaying these costs in FY21 allowed for the creation of one-time fund balances for strategic investment as revenue exceeded expenses.

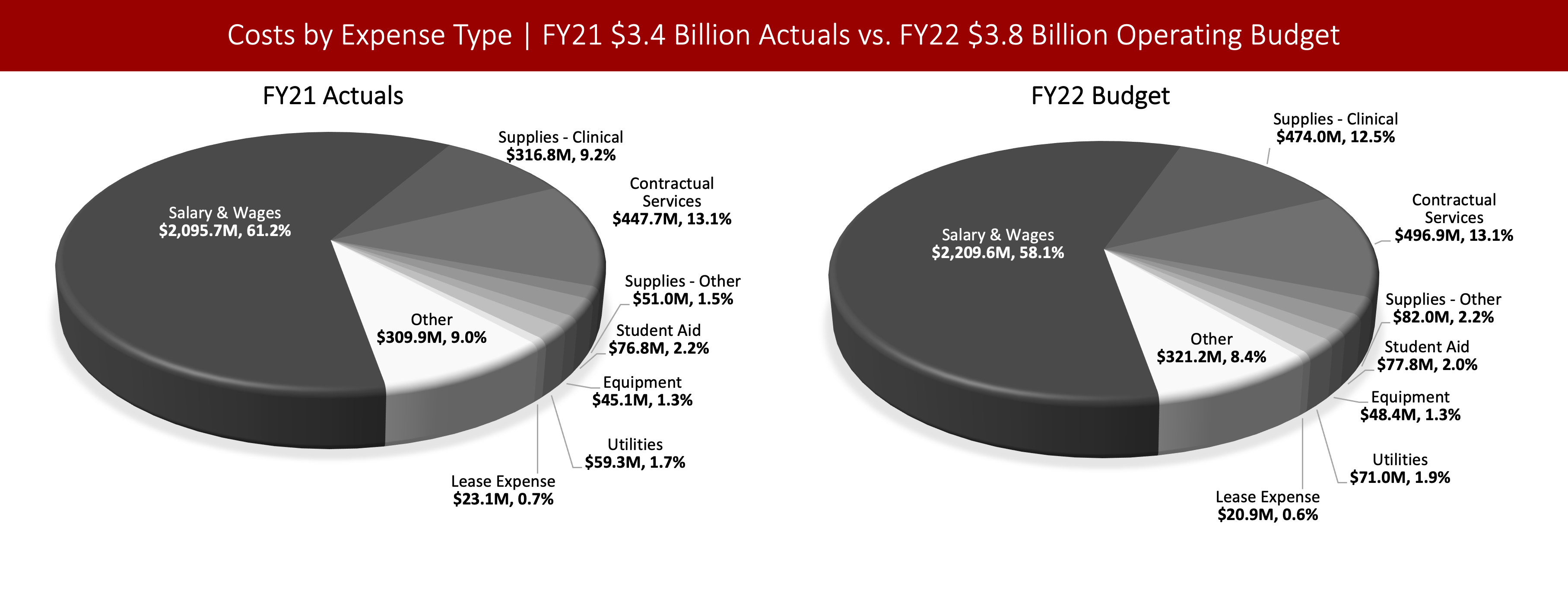

COSTS BY EXPENSE TYPE

FY21 $3.4 Billion Actuals vs. FY22 $3.8 Billion Operating Budget

These charts show the breakdown of costs across the entire organization by type of expense. Salary & Wages accounts for the majority at 58.1% in FY22.

Contractual Services accounts for 13.5% of the total budget. It includes but is not limited to contracted custodial service, grounds maintenance and maintenance of essential infrastructure, contacts with the FSA for catering and research funded subcontracts.

Supplies- Clinical accounts for 12.5% of the total budget. This category includes medical supplies such as prosthesis, surgical supplies, anesthetic materials, and oxygen as well as non-medical supplies such as cleaning supplies, instruments, and employee wearing apparel.

Other accounts for 8.4% of the FY22 Operating Budget and includes, but is not limited to, software license fees, mail and messenger services, printing and graphics, advertising and promotional expenses, general administrative expenses, telephone expenses, travel, and depreciation for full accrual healthcare entities.

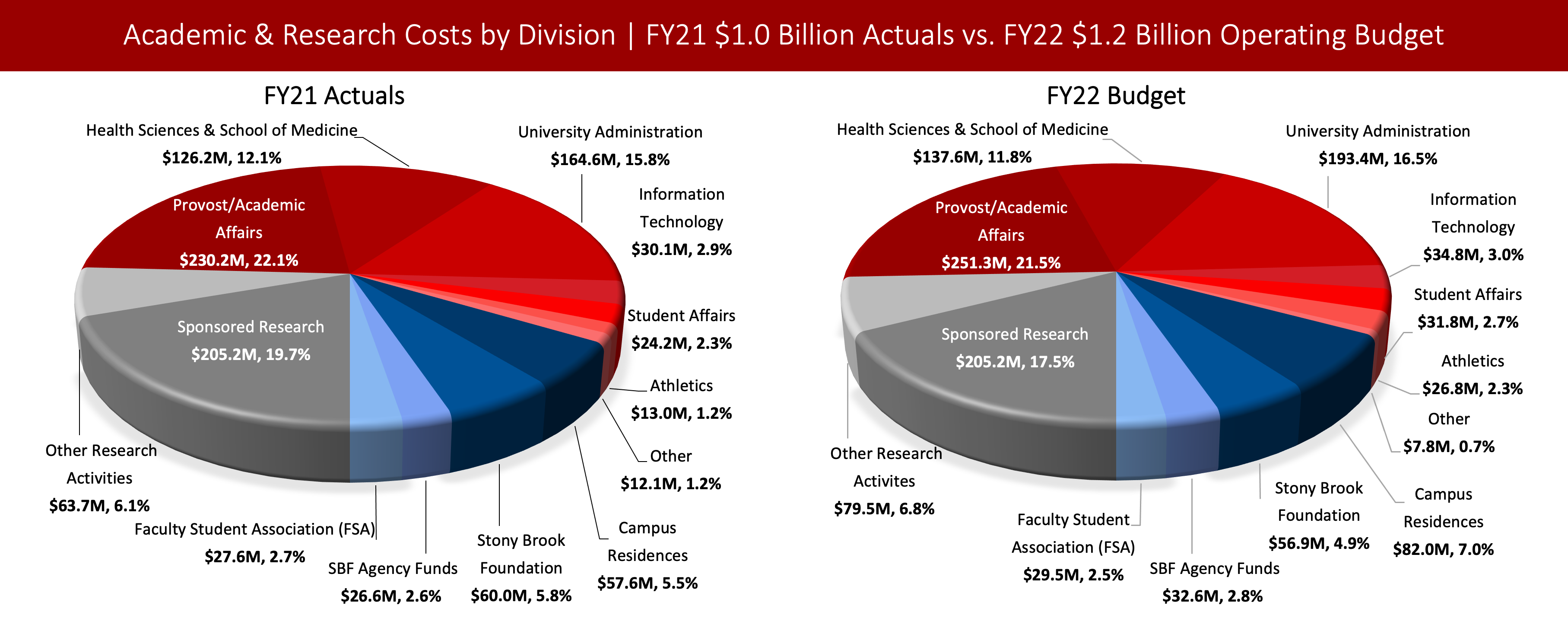

The following three sections show the breakdown of costs by division in the academic and research operations, including breakouts of the Stony Brook Foundation Support and University Administration. The highest expenses are reflected in the Provost/ Academic Affairs, followed by Research and Health Sciences/School of Medicine units.

ACADEMIC AND RESEARCH COSTS BY DIVISION

FY21 $1.0 Billion Actuals vs. FY22 $1.2 Billion Operating Budget

While costs in most areas are expected to remain relatively similar to FY21, we anticipate

notable increases in Campus Residences and University Administration due to the return

to full capacity in our residence halls and related increases in costs across campus.

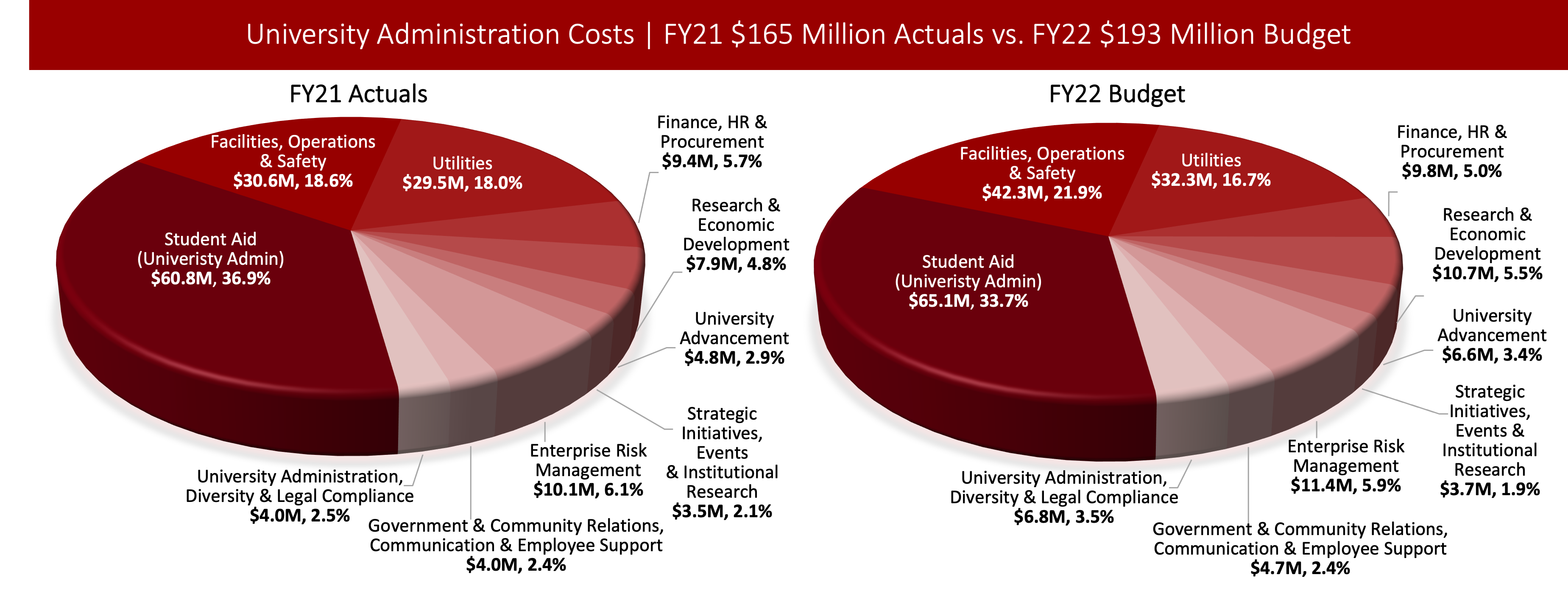

UNIVERSITY ADMINISTRATION COSTS

FY21 $165 Million Actuals vs. FY22 $193 Million Budget

The University Administration category includes much of the general operating costs

for the university including $42.3 million for Facilities, Operations & Safety and

$32.3 million for Utilities, which are expected to increase as Stony Brook resumes

operations that were limited by COVID-19 beginning in FY20.

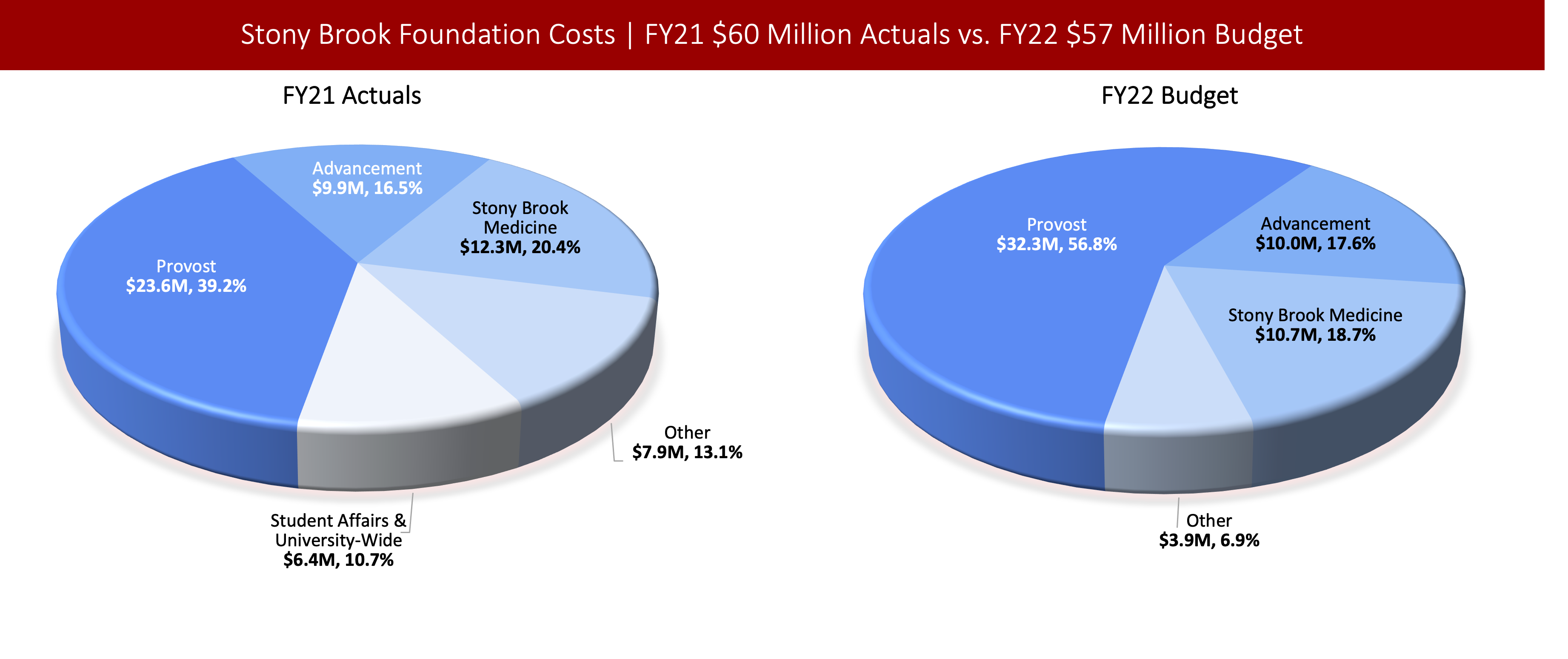

STONY BROOK FOUNDATION COSTS

FY21 $60 Million Actuals vs. FY22 $57 Million Budget

Annually, the Stony Brook Foundation (SBF) provides significant support to the operating

budget.

Student Affairs & University-Wide does not appear in the FY22 budget as those units have not projected the use of any SBF funds for FY22. Nearly $6 million of the $6.4 million FY21 actual costs were used to support students during the COVID-19 pandemic through a one-time use of scholarship reserves that is not expected to recur in FY22.

The SBF support reflected above includes external philanthropic support but does not include the $32.6 million categorized as SBF Agency funds elsewhere. “Agency Funds” represent pass-through funds owned by the university and invested by the Stony Brook Foundation on the university’s behalf.

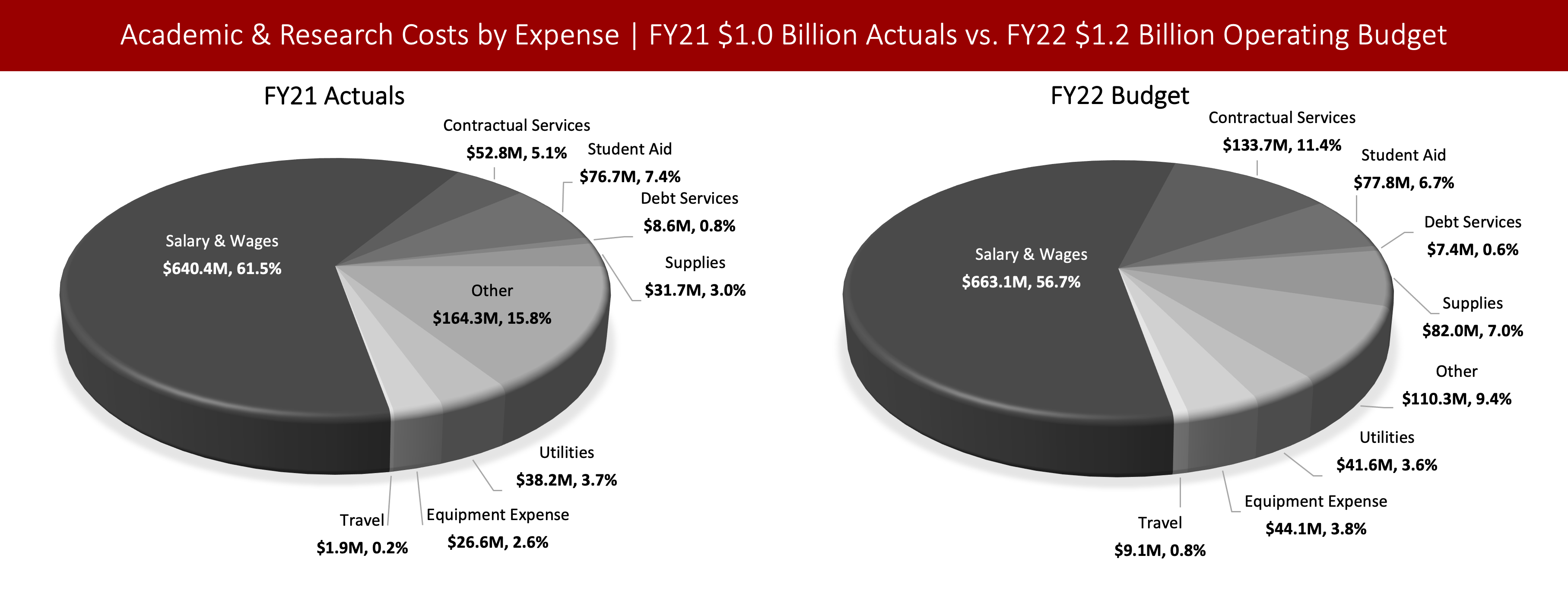

ACADEMIC AND RESEARCH COSTS BY EXPENSE

FY21 $1.0 Billion Actuals vs. FY22 $1.2 Billion Operating Budget

These charts show academic and research operations by type of expense. Salary & Wages

account for the largest portion of the FY22 budget (56.7%), followed by Contractual

Services (11.4%), Other (9.4%), and Student Aid (6.7%). Other includes but is not

limited to indirect costs of practice, expense transfers, and subawards.

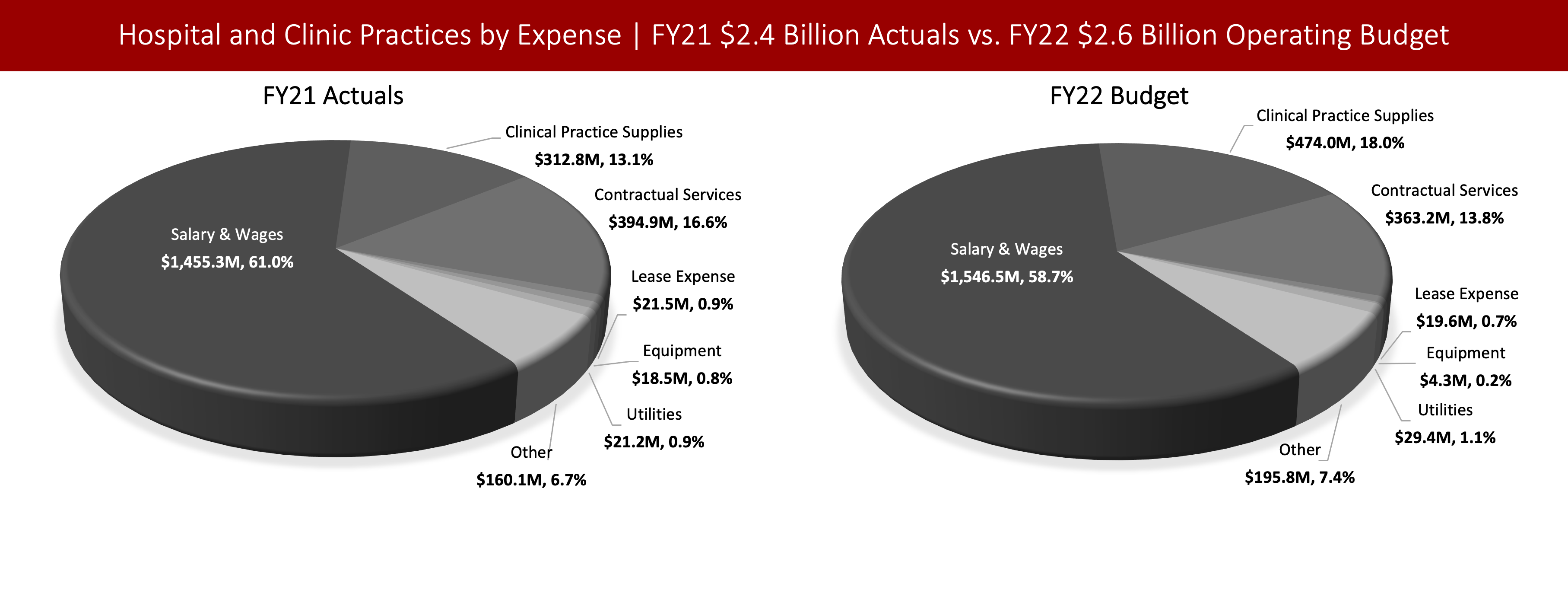

HOSPITAL AND CLINIC PRACTICES BY EXPENSE

FY21 $2.4 Billion Actuals vs. FY22 $2.6 Billion Operating Budget

These charts show hospital and clinic practice operations by type of expense. Salary

& Wages account for the largest portion of the FY22 budget at 58.7%, followed by Clinical

Practice Supplies (18.0%) and Contractual Services (13.8%).

FY22 HOSPITAL AND CLINIC

FY22 Hospital and Clinic Budget Funding vs. Costs

In FY22, hospital and clinic facilities are expected to operate in a deficit due to

COVID-19 impacts and costs that were deferred from FY21 to FY22. While functions have

been able to resume since the onset of COVID-19, medical facilities continue to be

influenced by industry-wide challenges including fluctuating patient volumes and demand

for services. A portion of FY22’s disproportionate increase in expenses relative to

revenue reflects stifled growth expectations, the impact of inflation, and the need

to reinvest in operations after two years of austerity.

| Hospital and Clinic | Funding | Costs | Surplus (Deficit) |

|---|---|---|---|

| SBU Hospital | $1,540 M | $1,608 M | ($68 M) |

| Southampton Hospital | $217 M | $218 M | ($1 M) |

| Eastern Long Island Hospital | $60 M | $64 M | ($3 M) |

| Clinical Practices | $674 M | $674 M | - |

| Veteran's Home | $62 M | $70 M | ($8 M) |

| Total Hospital and Clinic | $2,553 M | $2,633 M | ($80 M) |

FY22 ACADEMIC AND RESEARCH

FY22 Academic and Research Budget Funding vs. Costs

Academic and Research activities anticipate a one-time, expendable return on research

investments in FY22, resulting in a $36 million increase to funding without incurring

parallel costs. While the rest of the academic and research budget has little variance

between funding and costs, this non-recurring infusion creates a $35 million surplus.

| Academic and Research | Funding | Costs | Surplus (Deficit) |

|---|---|---|---|

| Academic and Support | $760 M | $766 M | ($5 M) |

| Sponsored Research | $205 M | $205 M | - |

| Other Research Activities | $85 M | $79 M | ($5 M) |

| Research Investment Income | $36 M | - | $36 M |

| Stony Brook Foundation | $57 M | $57 M | - |

| SBF Agency Funds | $32 M | $33 M | - |

| Faculty Student Association | $29 M | $29 M | ($1 M) |

| Total Academic and Research | $1,204 M | $1,169 M | $35 M |

FY22 OPERATING

FY22 Operating Budget Funding vs. Costs

Stony Brook expects to realize many of the costs that were deferred from FY21 in FY22.

We anticipate a deficit of $80 million on the hospital and clinic side, offset by

a surplus of $35 million on the academic and research side, for a net deficit of $45

million which will be covered by the rollover of funds not spent in FY21.

| Funding | Costs | Surplus (Deficit) |

|

|---|---|---|---|

| Hospital and Clinic | $2,553 M | $2,633 M | ($80 M) |

| Academic and Research | $1,204 M | $1,169 M | $35 M |

| Total Operating Budget | $3,757 M | $3,802 M | $45 M |